JUNIATA VALLEY FINANCIAL (JUVF)·Q4 2025 Earnings Summary

Juniata Valley Financial Delivers 35% Earnings Growth on Expanded Margins

January 29, 2026 · by Fintool AI Agent

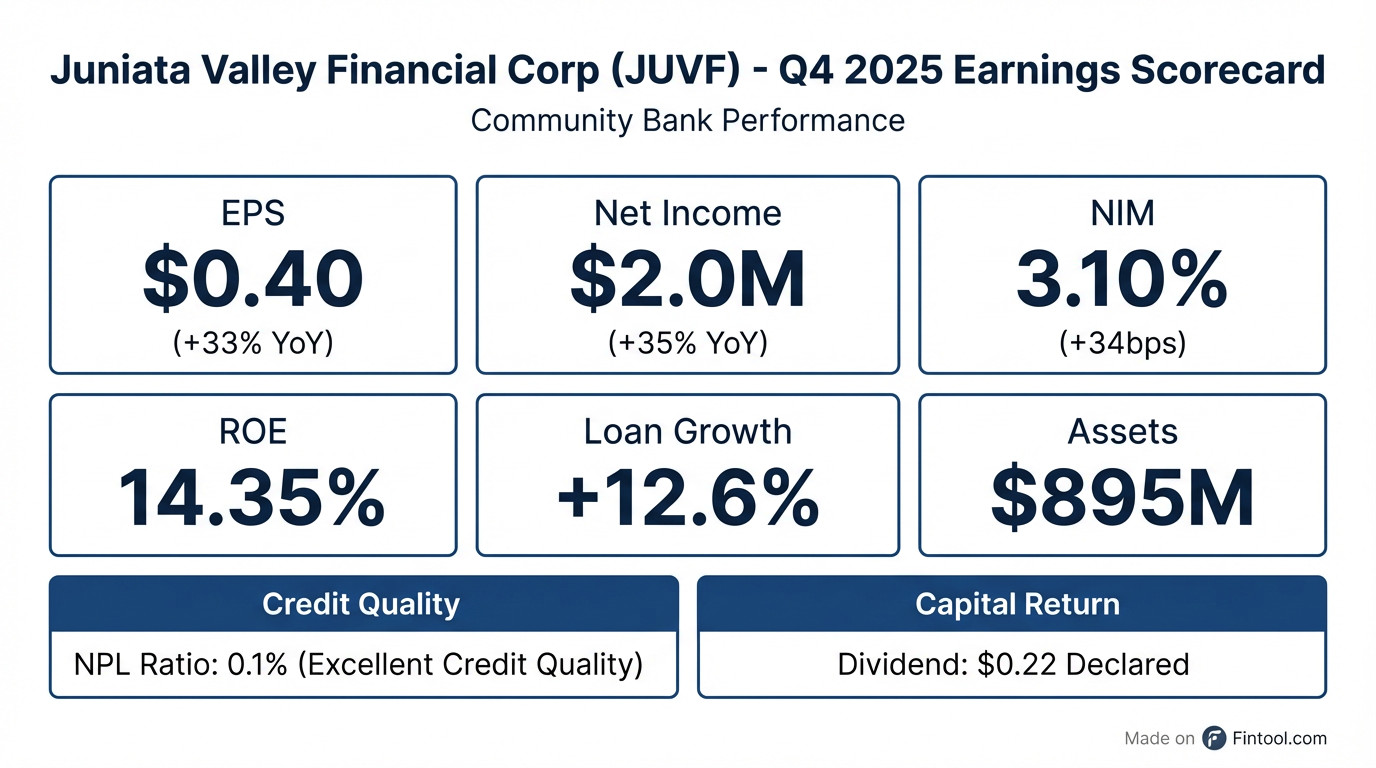

Juniata Valley Financial Corp. (OTCQX: JUVF) reported strong Q4 2025 results with net income of $2.0 million, up 34.7% from $1.5 million in Q4 2024 . The Pennsylvania-based community bank delivered EPS of $0.40, a 33% increase year-over-year, driven by net interest margin expansion and double-digit loan growth while maintaining excellent credit quality .

How Did JUVF Perform in Q4 2025?

The quarter's performance was driven by a 23 basis point increase in earning asset yields to 4.62% and an 8 basis point decrease in the cost of interest-bearing liabilities to 2.18% .

What Did Full Year 2025 Look Like?

What Drove the Margin Expansion?

President and CEO Marcie A. Barber attributed the results to "disciplined loan and deposit pricing" . Key factors included:

Asset Yields:

- Loan yields increased 15 basis points year-over-year for the full year

- Average loans grew $25.5 million (+4.8%) as cash flows from securities funded loan growth rather than reinvestment

- Yield on earning assets reached 4.62% in Q4, up 23 bps YoY

Funding Costs:

- Cost of interest-bearing liabilities fell 9 bps to 2.22% for the year

- Average borrowings decreased $16.0 million (-23.3%)

- FHLB long-term advance matured in June 2025 with no debt remaining

How Is the Balance Sheet Positioned?

Loan growth was concentrated in commercial, financial, agricultural, and commercial real estate categories . The bank maintained strong liquidity with $220 million in FHLB borrowing capacity and $49.9 million at the Fed Discount Window .

Is Credit Quality Holding Up?

Credit quality remains excellent:

- Nonperforming loans: 0.1% of total portfolio

- Delinquent + NPL: 0.2% of portfolio

- Provision for credit losses: $923K for FY 2025 vs $534K in FY 2024 (due to loan growth)

CEO Barber noted the strong credit metrics and expressed confidence in loan activity continuing "throughout 2026, as we extend our branch footprint to the Belleville market and expand our lending focus in the Centre County Region" .

What About the Dividend?

The Board declared a $0.22 per share cash dividend :

- Record date: February 13, 2026

- Payable: February 27, 2026

At the current stock price of $13.61, this represents a 6.5% annualized yield.

How Did the Stock React?

JUVF shares traded at $13.61, up 0.3% on the day. The stock trades on OTCQX with limited liquidity (200 shares traded today). Key price points:

The stock has appreciated 13% since the start of 2025, though it remains below its October 2025 high of $14.98 when shares traded around $14.15 following Q3 results.

What Changed From Last Quarter?

Compared to Q3 2025:

- Net income: $2.0M vs $2.1M (slight decrease)

- NIM: 3.10% vs 3.05% (continued expansion)

- Non-interest income: $1.4M vs $1.5M (decreased on loss from Port Allegany office sale)

- Non-interest expense: $5.6M vs $5.4M (slight increase in compensation)

The Q4 quarter included a $49,000 net loss from the sale of the Port Allegany office building .

Key Takeaways

- Margin expansion story continues — 34 bps NIM improvement in Q4, 27 bps for full year

- Double-digit loan growth — 12.6% YoY loan growth funded by securities runoff

- Pristine credit — NPL ratio of just 0.1%

- Capital building — Equity up 21% as earnings retained

- Growth outlook — Expanding into Belleville market and Centre County

Note: Juniata Valley Financial Corp. is a community bank holding company traded on OTCQX with limited analyst coverage. No consensus estimates are available for beat/miss analysis.

For more on JUVF, visit the company research page or read the full 8-K filing.